Day trading, a lucrative yet demanding strategy, is how professional traders make a living. It requires a significant investment, often running into thousands, if not millions, of dollars. A hefty inclination towards day trading resonates amongst several people, notwithstanding the formidable financial prerequisites.

Day trading involves purchasing shares, futures or foreign exchange and selling them before the closing bell. The limiting holding period ensures that short-term market fluctuations significantly impact profits or losses in day trading.

Day trading demands strong analysis ability, risk management skills, and a higher degree of emotional stability to handle the financial volatility. Moreover, to conduct successful trades, in-depth knowledge about market trends and financial indicators is crucial.

The cornerstone of any successful day trading venture lies in a well-constructed strategy. Such a strategy includes proper entry and exit points, setting the right stop-losses, and calculating potential profit margins.

Although the rapidly realizable returns from day trading might be alluring, the risks involved should never be overlooked. In the blink of an eye, substantial losses can wipe out a trader’s day trading account. Therefore, experts often recommend that novices commence with a virtual or demo trading account, to familiarize themselves with day trading nuances, devoid of any real money risks.

Achieving success in day trading wholly relies on education, adequate practice, judicious money management, and effective emotional control. Even though the prospect of rapid profits seems engaging, potential losses might also be catastrophic. Yet, with the proper guidance, dedication, and knowledge, 'trade the day' could potentially morph into a profitable undertaking.

Judd Nelson Then & Now!

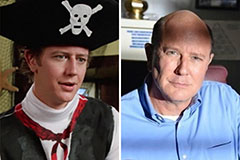

Judd Nelson Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!